1.5 税费设置

简介和业务影响

为了让美国用户了解需要支付的商品的确切价格,面向美国境内商品的商家必须提交他们收取的税费。如果您的商家将定位到美国,我们建议您在集成中提供在帐号级别对此进行设置的功能。详细了解税费设置的运作方式及何时使用此类设置。

如需了解如何针对非美国国家/地区提交税费要求,请详细了解如何设置商品价格以满足相关要求。

用户体验指南

下面列举了一些示例来说明您可以在集成中构建的内容,以便指导商家通过集成代收税费,并根据需要将税费重定向到 Merchant Center。

方法 1:引导商家通过集成来使用基于目的地的税费

- 向客户展示用于决定如何设置税费的选项。系统将提示商家选择使用基于买家位置的税率或不使用基于买家位置的税率

- 商家将选择基于目的地的税率,该税率将使用通过 Content API 进行的设置

- 选择后,商家可以点击“确认”,然后会看到一则确认信息,提示其税费已设置。

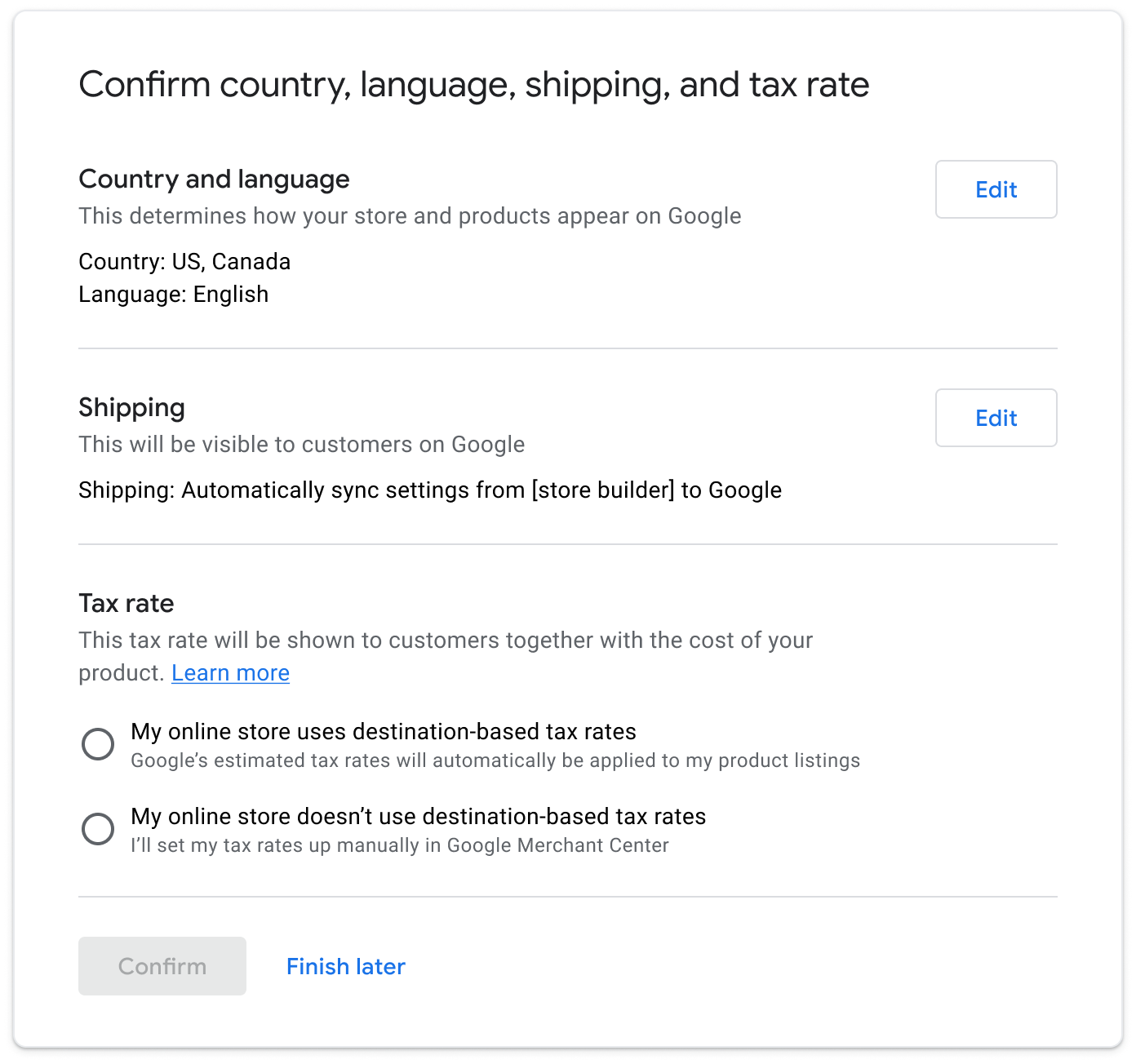

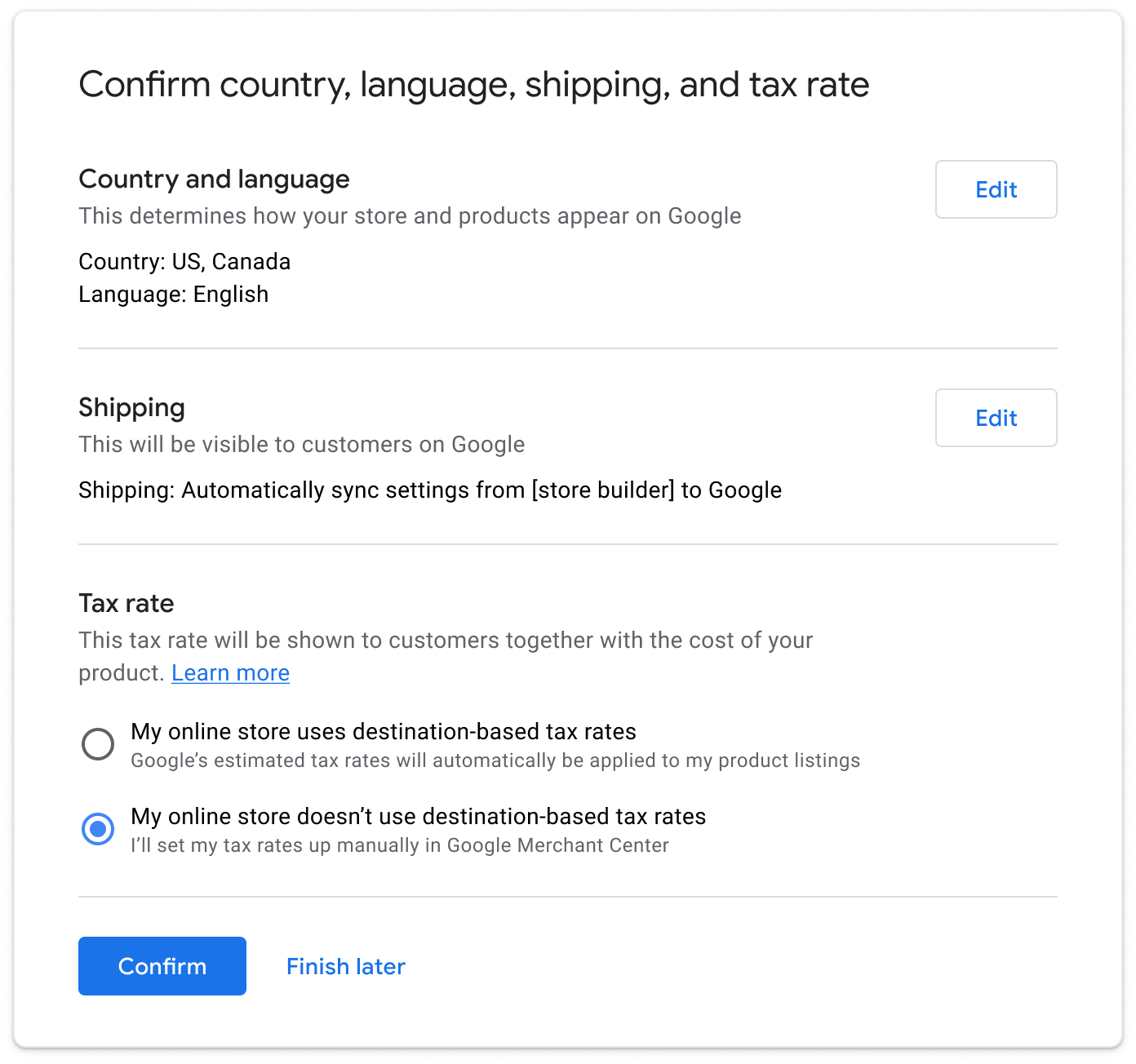

商家首先会看到帐号级税费设置页面:

系统会提示商家选择使用基于买家位置的税率或不使用基于买家位置的税率:

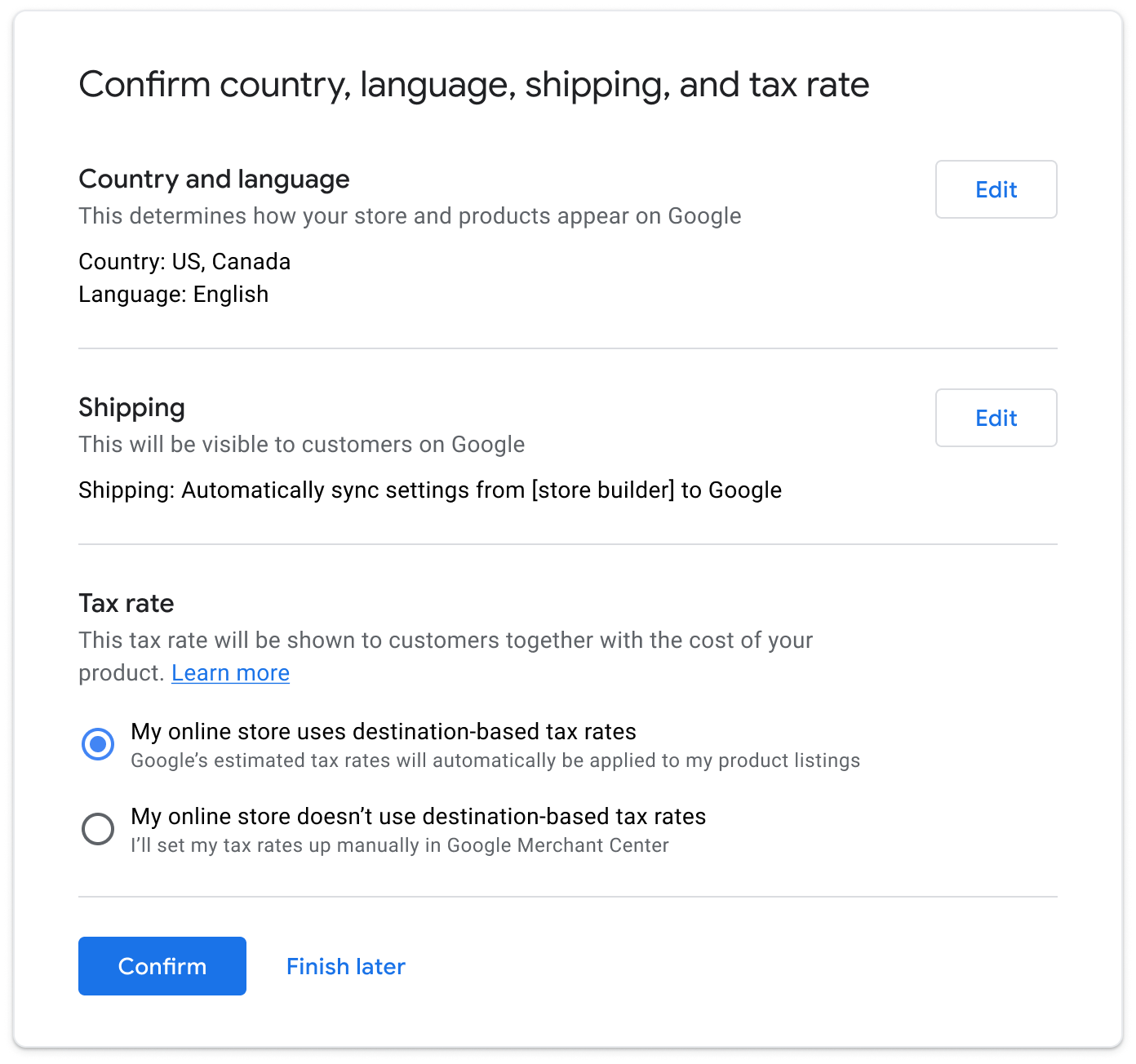

系统会提示商家选择使用基于买家位置的税率或不使用基于买家位置的税率:

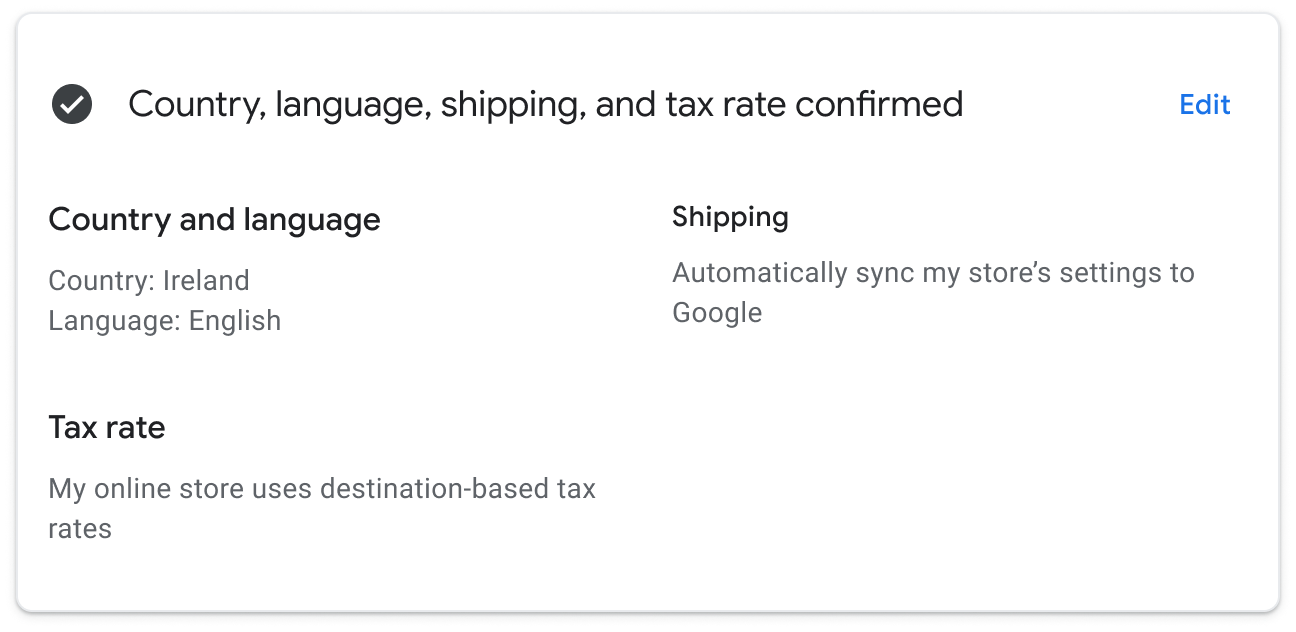

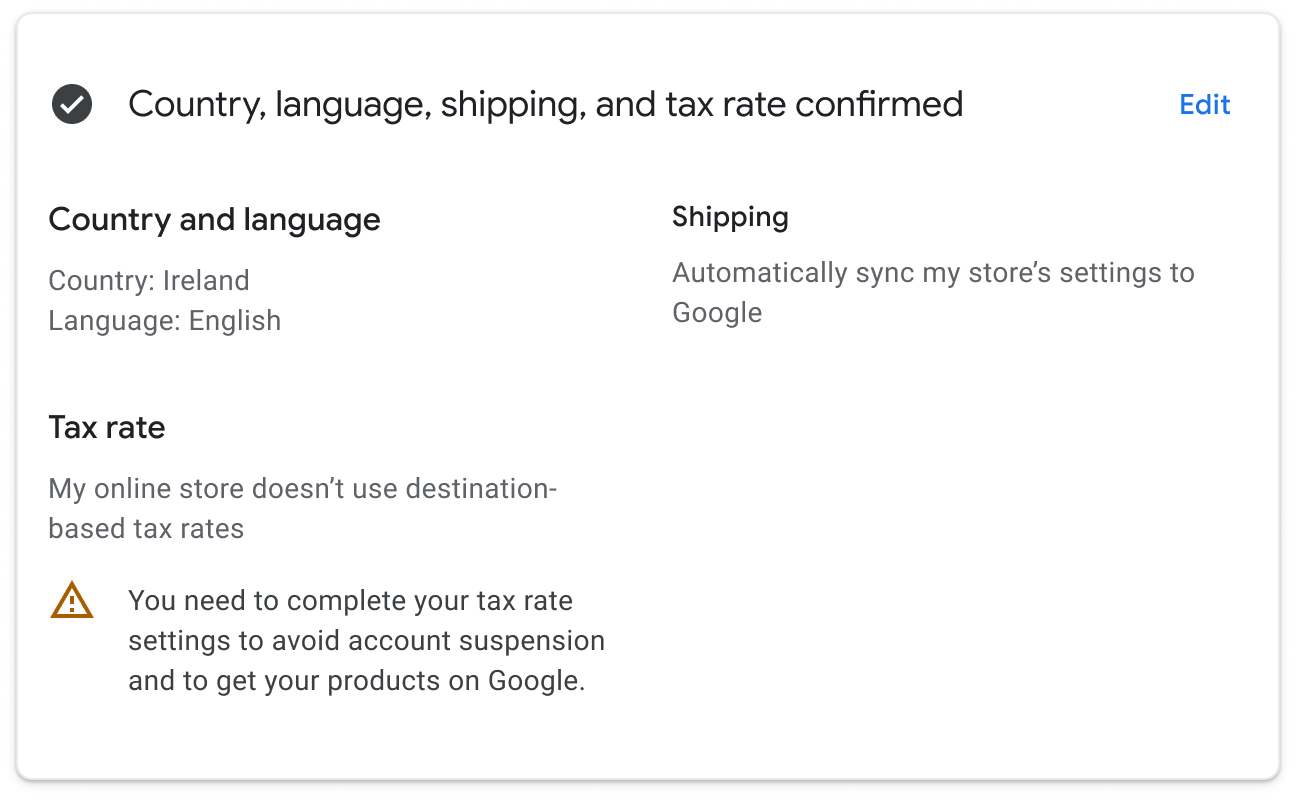

选择后,点击“确认”,您将看到税费已设置完毕的确认消息:

选择后,点击“确认”,您将看到税费已设置完毕的确认消息:

方法 2:引导商家将他们重定向到 Merchant Center 以进行更复杂的设置。

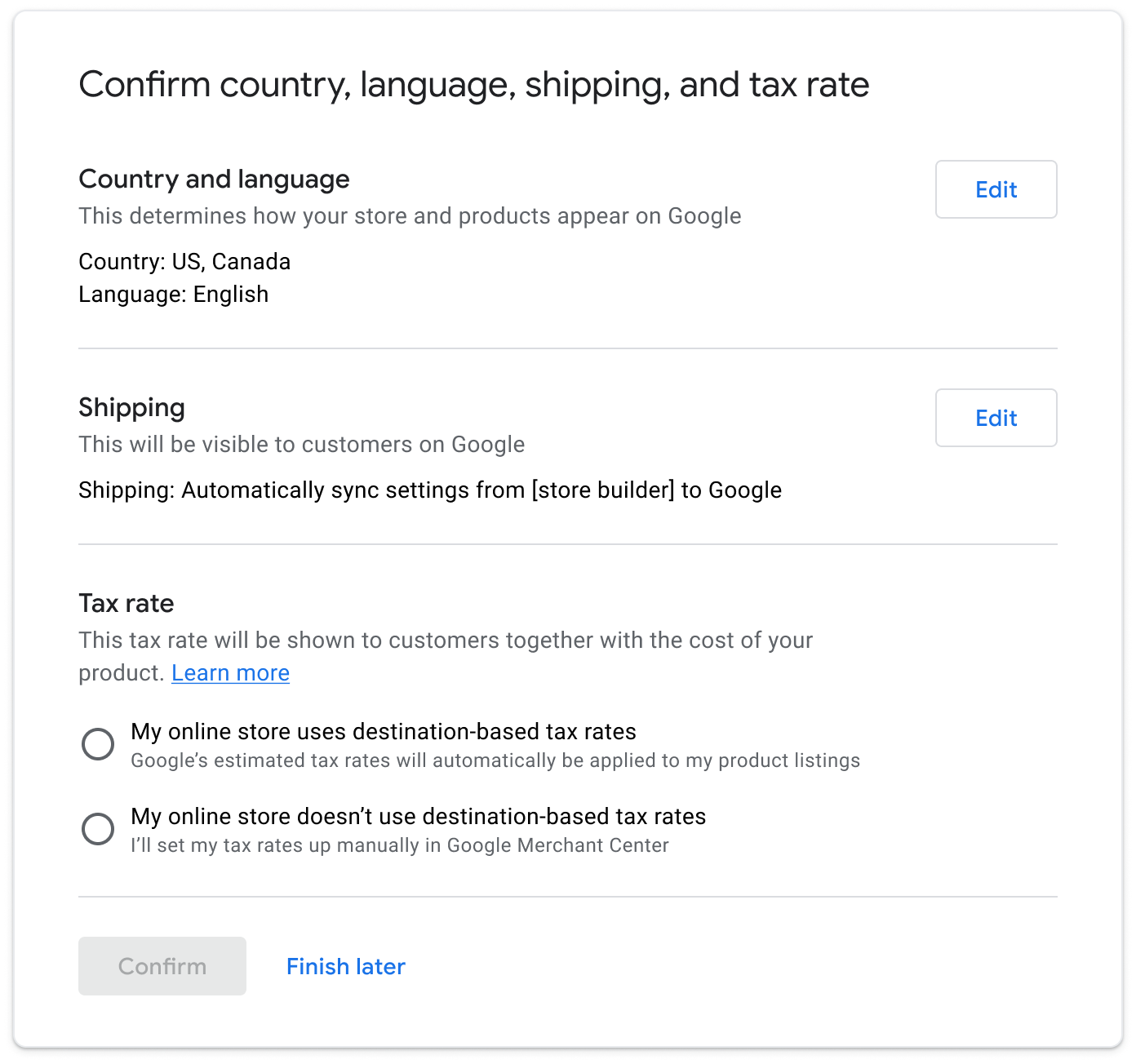

向客户展示用于决定如何设置税费的选项。系统会提示商家选择使用基于目的地的税率(即使用 Content API 进行设置),或者不使用基于目的地的税率(会将其重定向到 Merchant Center)。

然后,商家将选择不使用基于目的地的税率,这会将其重定向到 Merchant Center。

然后,商家将选择不使用基于目的地的税率,这会将其重定向到 Merchant Center。

选择后,商家可以点击“确认”,他们会看到一条消息,提醒他们需要在 Merchant Center 中完成此步骤。我们建议您添加此关联,这会将他们引导至自己的 Merchant Center 帐号,以便设置税费。

选择后,商家可以点击“确认”,他们会看到一条消息,提醒他们需要在 Merchant Center 中完成此步骤。我们建议您添加此关联,这会将他们引导至自己的 Merchant Center 帐号,以便设置税费。

技术指南

您可以通过以下几种方法确定如何为您的商家构建集成,以满足我们的税务要求:

使用 Content API 设置帐号税费:您可以让商家在帐号级别满足美国税务要求。如果您的大多数商家都面向美国销售,那么这种方法最适用于您的集成。

引导商家访问 Merchant Center:如果您的大多数商家都不面向美国销售,或者商家的设置较为复杂,则可以考虑采用此方法。

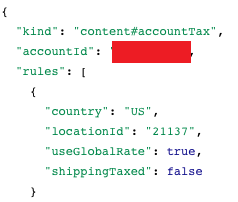

使用 Content API 的帐号税费设置

借助 Content API,您可以使用 Content API 端点 accounttax 服务来指定帐号税费。请注意,tax 属性(据此使用 accounttax 服务)仅适用于面向美国销售的商品。accounttax Content API 服务是 Merchant Center 界面功能的镜像。系统将利用 Google 估算的税率自动应用。

如果您希望更精确,可以在商品级别指定税费,但这需要执行额外的操作才能集成此功能。

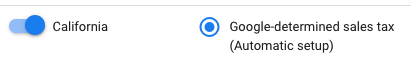

账号税费设置 - 实施基于目的地的税率

此设置适用于设置简单的商家,即在一个州开展业务的商家。为此,我们建议您将 1 个商家运营的州/省/自治区/直辖市设置为正常运营。您可以通过您系统中的商家运营地址提取此信息。确保将“useGlobalRate”工具设置为 True,以启用 Google 确定的销售税。

Merchant Center 界面示例

API 调用示例

将商家引导至 Merchant Center

如果您决定利用我们在用户体验示例中演示的内容,并允许商家选择实施基于买家位置的税率,则商家选择的另一个选项是:

我的商店不使用目标平台税费设置

我不确定,或者设置比较复杂

对于这些选项,我们可以引导商家前往他们的税费设置页面,让他们直接在 Merchant Center 中设置税率。如果您不打算在集成中构建帐号级税费设置,则应列出税费要求,并引导商家前往 Merchant Center 设置税费设置。